I don't mind picking up the crumbs.

It usually works for Warren Buffet. He has done it time and time before. He did it with LTCM in 1998, and now he did it with Goldman Sachs. The mighty GS are now a commercial bank, as we bid farewell to the era of the glory days of investment banking as we know it (or don't know it, as no one seems to know what the fuck is going on). Sadly, Morgan Stanley , who is full of brilliant Lebanese financiers such as CEO John J. Mack, and co-president Walid Chammah , among many others, also had to switch to the more regulated, tighter commercial banking sector, so the Federal Reserve can have their back. (I think the Fed can be renamed F'ed at the moment). Anyway, Warren Buffet took a $5 billion stake in Goldman , to save it from crumbling.

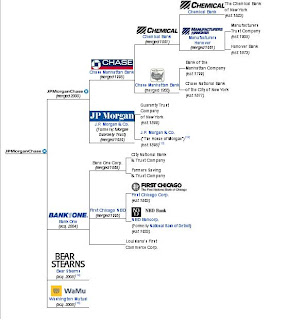

The other news that JP Morgan has swooped in to buy Washington Mutual , which was the biggest savings and loans bank in the USA. JP got them for a mere $ 1.9 Billion, which is pretty cheap considering. WaMu 's collapse was the largest bank failure in US history. (Which reminds me, the Northern Rock saga was the first run on a bank in the UK for 140 years - and in 2008, we almost had two, as Bradford & Bingley seems to be in a pile of shite).

I can see what JP is doing.

JP Morgan Chase, is now the biggest bank in the United States by far. What I think one of the strategies of Jamie Dimon, is to make JP so massive, that it just can't fail. It becomes such a behemoth, that it is so diverse and massive of a company, that it just can't go bust. It's the IBM effect. These behemoth companies, although can go into difficulties, are so large, that they become able to evolve as businesses. i.e. IBM, 20 years ago, was mainly a hardware company, yet, today, 54% of IBM's revenue comes from software and services, and its PC division, the same division responsible for the PC revolution of the 80s, and the key behind the rise of Microsoft (history note: When IBM started selling PCs left and right, it forced its consumers to purchase MS-DOS, which was Microsoft's flagship operating system at the time (now also known as Dummy OS), and Microsoft made millions out of royalties, which Bill Gates, no matter how much people hate him, mad a shrewd business decision to invest in R&D, and mainly in Graphical User Interfaces (GUIs) ). The strategy anyway seems to be working, and after buying out Bear Stearns, now they bought WaMu, and are well on the way of become one of the pillars of the US economy - the IBM of the financial industry. Just too big to fall.......

Check this picture i found:

[Source: Wikipedia article]

Now why do I have this urge of saying "Hi, and welcome to Goldman Sachs telephone banking. I am Tina and how can I help you today?" hehe.

No comments:

Post a Comment